This is the second [of an unknown number] of posts on a series on financial investing. I write this in order to brush up on what I learned from studying investment strategies, as well as to promote the practice with those who read it. I do not claim to be an expert, and I welcome any comments/suggestions to improve this series.

My father has always told me: “You won’t get rich from working your profession alone.” In his quest for financial security, my father has told me of the many ventures he went into different ways to gain capital, i.e. that thing you need to invest. The techniques to gain this needed resource will be discussed in this article.

What you Need: Capital!

turningpointbizcoach.com

Capital is defined as “wealth in the form of money or other assets owned by a person or organization, or contributed for a particular purpose such as starting a company or investing.”

When you begin investing, don’t feel bad if you don’t have much of this. Capital is a powerful resource, and if you invest wisely, that small amount of money will yield great dividends in the future.

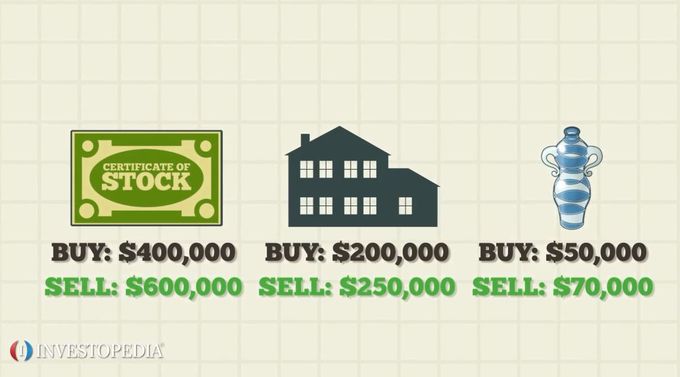

Gaining Capital

investopedia.com

There are a myriad of ways to earn money in the world. They can be classified into each of the following techniques to [legally!] gain capital. These include, but are not limited, to the following:

- Wages/Professional fees

- Interest from Loans

- Business ventures

- Real Estate

- Jewelry/Possessions

- Investments/Securities

We’ll take these one by one, how they provide capital, assessing their pros and cons, and how you can acquire and use them in the future.

Wages/Professional fees

Your job, whatever you may do, is the backbone by which you will gain capital. Therefore, if you aren’t one “born with a silver spoon”, this is your key towards a life of financial security.

It’s a pretty straightforward way to gain capital. You come into work, put in an honest day, and get an honest day’s pay. Yet it is also one with the greatest risk, as its productivity is entirely dependent on yourself. Your ability to work will depend on several factors such as your health, your passion, your goals/dreams, and your family.

The pros of this technique is that it gives you capital continuously, assuming that the work opportunities in your area are stable. This technique also has the added benefit of giving you social capital, that is, making friends, expanding your network, and gaining expertise.

The cons of this technique is that it is still liable to the influence of market forces – the wage you earn today may not be enough to buy the goods you need in the future. Some people resolve to just put in their hours in the daily grind, earning money until their twilight years. But the problem with this technique is that it will not last forever – you will at some point have to retire, for whatever reason.

When it comes to investing, this is the technique you’ll want to give most of your energy and time into. In other words, you have to invest in yourself. Become a product that society needs, and do your work honestly and passionately. The capital will reap itself in time.

Interest from Loans

Most of you reading this will probably have a bank account already. By depositing money in a bank, you gain some interest. Interest is “money paid regularly at a particular rate for the use of money lent, or for delaying the repayment of a debt.”

The pros of this technique is that it is very low risk. In the Philippines, deposits these days are insured a maximum of Php 500,000, which has helped prevent bank runs in the past. While interest rates yield small amounts of capital, it is still capital and could be invested. This is also a technique that can be held onto indefinitely, unlike a job.

The cons of this technique is that it is generally very low return. Interest rates these days are minimal, and do not defeat inflation rates. You can check the first post of the series to know more about how inflation is the “silent killer”.

Having a bank account is a prerequisite to investing (esp. in securities), so if you don’t have one, I highly recommend opening an account. However, don’t depend on this to gain capital, because you will lose in the long run.

Business Ventures

By going into business ventures, capital can swing both ways. Lucky and prudent businesses grow into stable companies and will earn money, while the converse will lose the game.

The pros of this technique is its possibility for high returns and, if done correctly, its ability to provide the owners a means to continuously earn money. But that’s an understatement.

The cons of this technique is that it is also very high risk. The capital to establish a business is also very significant. Establishing a business requires a lot of work – you’ll have to put in time and knowledge in order to make it grow. Businesses are in the center of the storm of the market forces – hence, luck is also something you’ll need for business.

Some people were born to do business. Some people, like myself, prefer to ride the waves of their success. Keep this option open, and discover if you have the stomach for it.

Real Estate

The oldest trick in the book. You buy/inherit land, you hold onto it, and you sell it or rent it. Other variations would be building townhouses for which you can obtain lease from your tenants.

The pros of this technique is that it provides great capital and is a potential resource you can use to build capital-making businesses on. Its value also appreciates with time. This is a great technique to earn money – if you’re rich, or born into a landowning family.

The cons of this technique is that it requires great capital. Depending on its location, its value may also depreciate with time. You’ll also need to think of the taxes/bills you’ll have to expend to maintain ownership. If you’re someone trying to make it into the world, this is a technique you’ll have to bide your time for. When you’ve sufficient capital from investing in other techniques, this is a frontier you must not forget to consider.

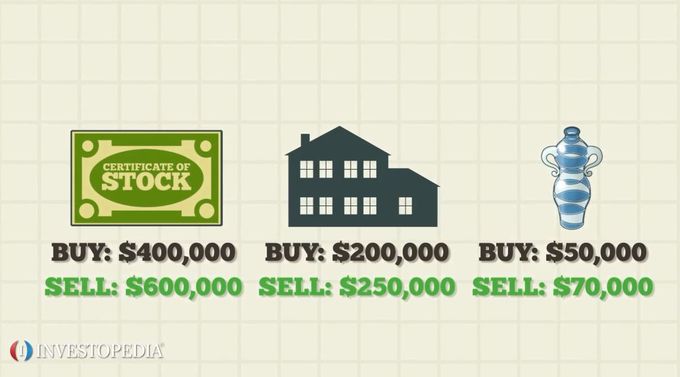

Jewelry/Possessions

Your possessions have intrinsic value that can be converted into capital. Jewelry is one of them. I don’t know much about the trade in jewelry, however, but selling these can offer you varying amounts of money.

The pros of these include its ability to appreciate with time, but that’s about it. The cons of this would be its susceptibility to market forces, as well as its susceptibility to make you a victim of theft.

Having jewelry and possessions helps you earn, but this shouldn’t be your primary means to earn capital, unless you’re in a family of jewelers.

Investments/Securities

Investing your money into the different investment vehicles also yields capital. An investment vehicle is a product used by investors with the intention of gaining positive returns. There are many investment vehicles, such as loans (e.g. time deposits), bonds, stocks, mutual funds, and exchange-traded funds. We’ll take the nitty-gritty of each one in another article.

The pros of investments include its accessibility to the common man, and its ability to defeat market forces, if used properly and wisely over a period of time. It is also a means to earn money without physically working, and one you can do indefinitely.

I always find it funny when people would remark how they picture investors as people who wear tuxedos and use monocles and sip champagne over stock market tickers, not knowing that it is the common man who plays the game.

When I began investing years ago, I thought this way as well. These are some misconceptions I’ve had, and debunked as I went through investing:

- I thought that investing required great capital. No; I could invest any amount I wanted to. (Note: some products require minimum investments to open an account however, so check with your bank/broker).

- I thought that investing made me lose control of where I put my money in. No; I choose the companies and products I wish to invest in, and I choose when to get my money when I want to.

- I thought that investing was a 24/7 job that would offer you no peace. No; first, there’s a test you’ll need to take to know what your “risk appetite” is, that is, your capacity to risk your money into something. Once you know how much you’re willing to risk, you’ll decide where you want to put in your chips – in stable, growing companies, or in new, dynamic ones.

- I thought that investing was hard to learn. Yes, you have to do some self-studying to learn about its process and its opportunities. I spent a month poring over websites and books that teach investing before I brought shares to a company. I also went to some seminars to learn about how investing works.

I don’t claim to be an expert, but I’m surprisingly gaining capital, thanks to the help of those books, websites, and people I’ve spoken to. I’m not in the big leagues, but I’m slowly gaining financial independence.

The cons of investment is its susceptibility to market forces thus making it a risky venture. There is always a possibility that the company/product that you invest in may fail, and you may lose what you invested. There is also danger in investing in ignorance. Two kinds of people lose in the stock market game – the unlucky, and those who are ignorant. Luck will never always be on your side, but if you invest wisely, you’ll at best breakeven, and at worst, learn from your misfortune. If you don’t invest wisely and do your research, however, you can lose everything you invested.

Afterword

basf-new-business.com

There is an adage in investing that goes: “Always be prepared to lose money.”

How is it that there are still people investing despite this adage?

It is because the wise investor only invests what he can lose (he knows his risk appetite), he accepts that market forces are fickle (he knows that, given enough time, he will regain what he loses), and he knows that fortune favors the bold.

Work smart, save up, do your research, and take the plunge.

I’ll see you along the way.